Nifty to touch 6000 if it crosses 4650: Rakesh Jhunjhunwala

1 2

Next page »

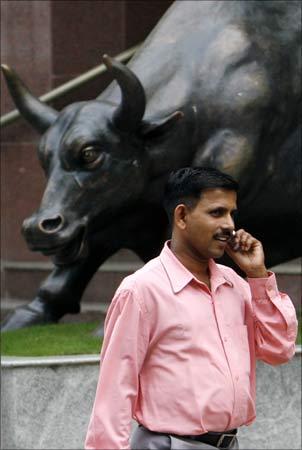

In a candid interview with CNBC-TV18’s Udayan Mukherjee, Rakesh Jhunjhunwala, one of India’s most respected equity investors, said the Sensex could go up to 20,000 and then slip into a trading range between 15,000 and 16,000. The benchmark index won’t hit 21,000 in a straight run though, the Big Bull said.

“If the Nifty breaks 4650 decisively and holds for a week or so, it could hit 5900-6000,” Jhunjhunwala said. The markets would consolidate between 4,000-5,000 for three-four years, he added.

The correction seen in the latter part of 2008, he said, was a part of a major bull run that continues and which started in September 2001. “The bull market started in September 2001. We had the first leg up to September 2002 after which there was a correction. Then it started from April 2003, that leg lasted till 21,000,” the ace investor said. “That gets corrected back now to 7,500-8,000 and now we have resumed that bull market. So we can go to 20,000 and again come back to 16,000-15,000, make a range and then make a move which goes above 21,000.”

Excerpts from Rakesh Jhunjhunwala’s exclusive interview on CNBC-TV18. Also watch the video.

Q: We spoke on the day after the election results. I do not think even we imagined the market would be here. What is the screen telling you now?

A: The screen is telling me that the bear correction of the larger bull market in India is over. If the markets do not break below 4,000 levels in the next six-nine months — and the screen is telling us they won’t — then surely the fall from 6,000 to 2,500 for the Nifty and from 21,000 to 7,500-8,000 for the index was just a correction in the longer-term bull market in India. Actually, in my opinion, the correction started in September 2001 because the real bottom the market made was post-September 11, 2001 and then the market went up to 3,500 and had a historic correction back from April 2003.

Despite people’s apprehension and doubts about the economic scenario worldwide, it could be that the fall [in 2008] was just a correction. I also feel so because of the way the [subsequent] rise took place with its tremendous breadth, tremendous pace with good volumes — but with a lot of cynicism and lack of participation among the larger people.

Q: You do not agree with the consensus feeling right now that we should be scared by the pace of the rise. That we are now approaching a mini bubble kind of a situation?

A: You first asked what the screen was saying, you never asked me what my opinion was.

Just like others, there is a fair amount of doubt in my mind too. Internationally, things are not clear at all and I do not think that the downturn in the western economies — even if there is some kind of an improvement in the next 12-24 months — has really peaked. So with that knowledge about the world economy, it clouds the judgement of what can happen in India.

However, If you look at the other side of the story, I see no reason why — if Indian software exports grow by 10-15%, commodity prices hold at reasonable levels and we have good government policies — India cannot grow at double digits. We have large internal savings. If we do well, the world capital will be at our doorsteps, there will be no lack of capital if the government is able to facilitate investments. So those are the two sides but I am more tilted towards the second side because in the initial stages, they say, bull markets always go up on a wall of worry and bear markets always go down on a ray of hope.

The fact is that market is just going up in an unexpected pace and everybody is worrying. Surely I am also apprehensive about the valuation and the pace but markets are markets.

Q: When you look at the screen, what worries you? Does it worry you that valuations are far ahead of fundamentals or do you see the kind of participation or mania that you saw in 2007 or that is not visible just yet?

A: Not at all, not even 5%. I don’t go to any cocktail party where stock markets are even talked because everybody is totally left out. And the futures positions are indicative, the number of calls you get, the apprehension that people have in the buy stocks — I don’t know where the buyers are coming from but I don’t think there is even 20% of the participation of that what was in 2007.

Q: Will they all get sucked in you think before this rally tops out, people who have been sitting out?

A: It is very difficult to leave a burning cigarette in a rising market. Everybody will ultimately join. I don’t know how many calls I got when we made a 52-week high. Normally, a lot of channels call me, no channel called me to get an opinion when the market was at a 52-week high. I don’t even know how many people know we were at a 52-week high.

So I think crowd psychology-wise or sentiment-wise, I don’t think at all we are anywhere near any kind of a top.

Q: Are you trading yourself with a bit more caution because you were saying you are also in two minds right now or are you trading the kind of volumes you were trading in the big momentum of 2007?

A: I don’t think I am trading the way II was in 2007. After all, I am a human too and I am also affected by what my thoughts are. However, I am far surer about the [country’s] longer-term growth prospects and the strength than most people.

On next page: Rakesh Jhunjhunwala on market range ahead

1 2

Next page »

****************************************

Nifty to touch 6000 if it crosses 4650: Rakesh Jhunjhunwala

Need reforms, FDI in insurance at 49%: Sunil Mittal

See 8% GDP in next 2-3 years: Uday Kotak

Source:Moneycontrol.com