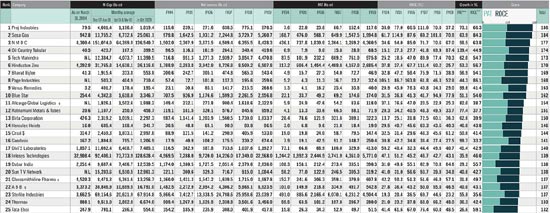

| Profit 100 Listing | |

| Profit 100 Ranking: Alphabetical | |

| Methodology |

***************************************************************

With crude at $79 and threatening to head lower, order-flow for machines that make bio-ethanol could slump. The company delivered blockbuster net profit numbers till last year as rising viability of alternate fuels ensured a wild rush towards green energy. The last reported order-book was Rs 800 crore with exports having a 35 per cent share.

4 Oil Country Tubular

Exports contributed about Rs 209 crore out of the Rs 422 crore topline in FY2009 on the back of the then boom in oil and gas exploration. In H1 of 2010, the drill pipe manufacturer has already clocked sales of Rs 200 crore against the planned Rs 325 crore.

11 AllCargo Global

The country’s biggest multi-modal services operator has private equity goliath Blackstone among its biggest investors. The slowdown in the export-import trade led to operating cash flows falling by 25 per cent in FY2009. Sustaining margins going forward will be a function of the robustness in global economic activity.

20 Sun TV Network

In South India it has a dominant presence in almost all the markets that it is present. Its regional positioning also protects it as that space is the last hit, when advertising spends are pared in a downturn. Greater focus on increasing non-advertising revenue (currently

40 per cent) via its DTH venture will keep this gravy train going.

21 GlaxoSmithkline Pharma

The product patent regime could see this multinational get aggressive with new product launches. For now, the company has passed onto consumers the reduction in

excise duty. Reduction in input costs as well as retention of duty cuts could sustain improved net sales. For H1 of CY09, net sales were up 9 per cent year on year at Rs 915 crore.

Click here for large table 1-25

23 Sterlite

The company is banking on its planned expansion in aluminum and zinc for an encore of the performance that it has delivered during the last boom. The acquisition hunt backed by balance sheet strength continues even as it grapples with delays in commissioning

its Orissa power plant. Among the best placed metal players to capitalise on any sustained global economic recovery.

29 Nava Bharat Ventures

For this diversified player, while the planned capacity expansion from 228 MW to 600 MW in the merchant power business will drive growth, the strain in ferro alloys and minor contribution of sugar division to the bottomline could refl ect in declining return ratios.

33 Colgate Palmolive

Low priced packs have enabled it to get a substantial share of the 35 per cent of all toothpaste sales that happen in rural India. Saving cream, soaps and shower gels still play second fiddle to toothpaste and brushes that deliver 90 per cent of revenue. Profitability could be under pressure due to slowing volume growth, loss of tax shelter and

37 Asian Paints

This decorative segment leader is further increasing its distribution reach through its Colour World outlets. Margins have improved in the international business primarily due to fall in inputs costs. Very strong brand equity enables it to pass on reasonable price hikes onto the end-user when required.

More on this: http://www.outlookprofit.com/article.aspx?262773

Source: OutLook Profit

No comments:

Post a Comment